I’ve said it several times on this blog – I am not really good with budgeting and financial management. It’s just not a strength of mine. I do know that it’s something that I want to figure out though, but every time I try to read up on the topic or attend talks about money, a lot of it doesn’t make much sense to me. I mean, I’d like to think that I’m pretty smart. It’s just that it takes me a while to register anything that has to do with numbers. That includes money. And so I found it totally amazing that I found I Wish They Taught Money In High School to be a quick an easy read.

Yes, finally, a super simple book about managing your money.

I literally finished this book in one afternoon. And no, I didn’t just skim through it. I actually read it, understood it and appreciated it. I must admit though that I enjoyed reading the I Wish They Taught Money In High School So I Can Start My Own Business Right Away part more. This is probably because it’s something that’s more appropriate to my present situation, and therefore, something I can relate to better than the second part, I Wish They Taught Money In High School So I’m Not Dependent on my Paycheck. Both are totally informative, though, and great to read for financial dummies like me. It would be a great book for those of you who do you understand your money matters too, because it gives a great perspective and ideas on how you can look beyond your paycheck for you to earn and become financially free.

Paycheck to paycheck no more.

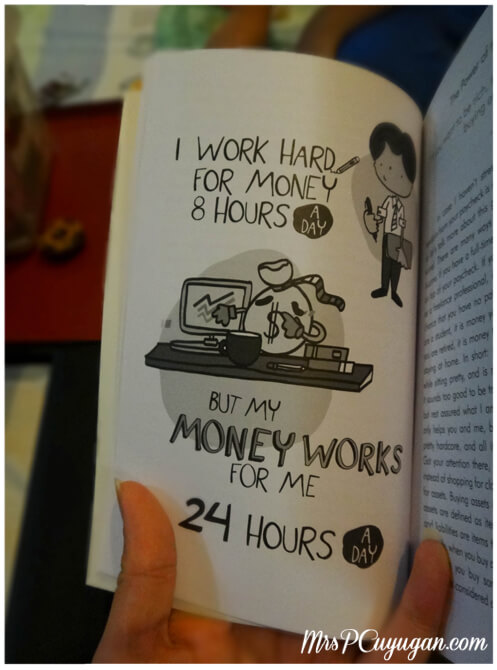

In this part of the book, author Clarissa Seriña-de la Paz talks about how she learned to look beyond her paycheck in order to grow her money. She shares her ideas on how you can invest, whether it’s through stocks or mutual funds, so that your money continues to work for you after you’re done working your 8-hours for the money. I love the concept of paying yourself first, which I heard about before at a financial talk I had attended. This is probably my best takeaway from this part of the book, a reminder that yes, you should be setting aside money to either save or invest, so that you will have money for the future when it’s time for you to retire.

You can start a business with little capital. Yes, you can.

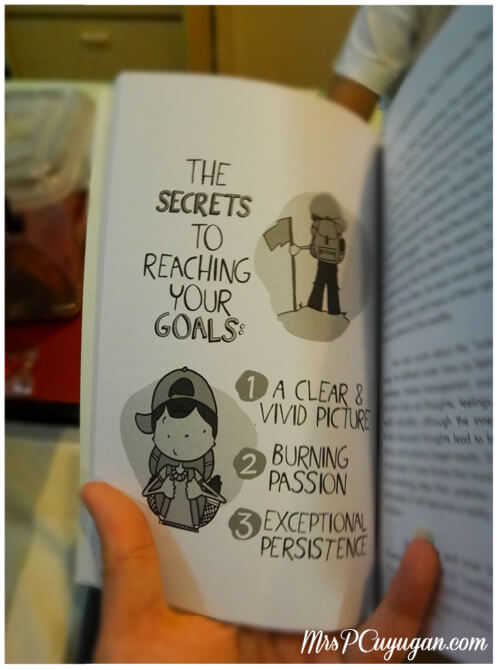

A friend and I have been toying with the idea of starting our own business since last year. There just are so many fears that come with taking a leap so big, but honestly, reading this book helped answer a lot of questions and clear up some of the doubt. Sharon Que who authors this part shared a lot of great, inspiring stories about starting small, about overcoming obstacles, and how patience and persistence can really pay off when it comes to business. I absolutely love how this part ends with steps on how to register a business, something that is super necessary for anyone who is even thinking about taking on an entrepreneurial venture to know. The author also shares a few ideas for businesses that don’t require a lot of capital, like online businesses and some franchises. My best takeaway from this portion of the book is the idea that yes it can be done, and the inspiration to just go and do it.

I’d say that this book is totally worth it, especially if you’re seeking any form of wisdom or clarity where your finances are concerned. In case you do decide that you want to read it, you can get a copy of I Wish They Taught Money In High School here. I’d love to know your thoughts once you’re done with the book!